- 两大全新职业登场 恶魔契约今日二测开启!

Two new professional debut demonic pact today second test opened!

天极网2015-08-20 11:31:18由韩国GINNO GAME研发、迅雷游戏代理的年度3D锁视角动作网游《恶魔契约》将于今日下午14时开启二测,测试资格发放进入最后倒计时,欢迎玩家前去官网了解、下载客户端,化身猎魔人,守卫阿尔卡纳大陆! 《恶魔契约》官网链接:http:/

- 大圣西游8月28日追开新服 斩妖除魔匡扶正义

Mahatma journey August 28 open to make track for new service cut a demon in addition to magic Kuang Fu justice

171732015-08-20 08:15:173DMMO动作次世代PK网游《大圣西游》于7月31日开启了首次测试。追随大圣的西游的脚步,一路斩妖除魔,大量热情的西游粉、大圣粉涌入游戏,官方为回应广大玩家的热情,将于8月28日19:00追开新服“斩妖除魔“。精彩纷呈的魔幻世界为你呈现,赶

- 海涛就文化部严查采访 行业或迎发展新逻辑

Haitao scrutiny of culture industry or interview to develop new logic

超级玩家2016-04-18 18:29:312016年4月,文化部公布,斗鱼、虎牙直播、熊猫TV、战旗TV等网络直播平台因涉嫌提供含宣扬淫秽、暴力、教唆犯罪等内容的互联网文化产品,被列入查处名单后,一直在打擦边球的各大游戏直播平台突遭重磅炸弹。同时,作为行业领军人物的ImbaTV的联

- 《糖糖大世界》评测 很精彩的三消世界

This kind of game of the sugar world "evaluation wonderful Sanxiao world

43992015-08-19 00:59:04三消游戏这类游戏想必是朋友们非常熟悉的游戏了,这类游戏没有入门门槛,操作简单,而且随时随地即可玩,是一类非常受欢迎的游戏。简单有趣的同时这类游戏也存在问题,玩法大致相同,游戏模式类似,似乎每一款三消游戏都差不多。不过今天熊仔体验的这款《糖糖

- 天猫双11晚会明星揭晓 看看有没有你喜欢的明星

Tmall double 11 evening star See if you like the star

TechWeb2016-10-24 21:48:49距离双11越来越近了,除了买买买,今年还能欣赏一场史无前例的超级大趴晚会。 此前,“2016天猫双11狂欢夜”组委会与深圳市政府正式对外确认:今年的双11晚会将落户深圳大运中心体育馆。 值得一提...

- 建筑工人到一夜爆红 阿杜回忆出道过往

Construction workers to night hit Freddy adu memories out past

千龙2016-10-05 00:53:32全新模唱综艺节目《隐藏的歌手》第二季本周日晚19:30上海娱乐频道、北京文艺频道、广州综合频道,21:30深圳都市频道四台联播,并同时在重庆时尚频道、杭州西湖明珠频道、江苏综艺频道、陕西生活频道、河...

- 业界良心名不虚传 CDPR表示免费DLC应成业界常态

Conscience of the industry have a well deserved reputation cdpr expressed support for the free DLC should become the industry norm

新浪2015-08-20 09:59:11《巫师3:狂猎》自发售以来推出了大量免费DLC(目前共计16个),其中游戏的新游戏+模式也随着最近一部免费DLC的上市而到来。有着“业界良心”之称的波兰游戏开发商CDProjektRed曾多次公开表示:游戏DLC应该免费!现在他们又对DLC

- 全智贤金秀贤面对三星星光派对进退两难 哀悼为何..

Jeon Ji Hyun Jin Xiuxian Samsung Star Party faced a dilemma condolences why ..

中国娱乐网2014-04-19 08:22:14三星电子面对18日中国的Galaxy星光派对站在了非常尴尬的立场 三星电子本想通过“韩流大势”全智贤与金秀贤准备了大型的宣传活动。然而,随着珍岛客轮的沉没事件,全韩国国民都陷入了一片阴沉。 在此之前,三星电子大肆宣传了,将于18日下午在中国

- 百亿资本涌入、市场规模超1900亿元,这是便利店最好的时代?

Ten billion yuan of capital influx and over 190 billion yuan of market scale are the best times for convenience stores?

投资界2019-03-30 10:29:00在这个便利店最好的时代,如何掌握正确的经营之道成为了重中之重的问题。

- 恒大重修主场草皮 专业球场?短期内基本不可能

Hengda rebuilt home turf professional stadium? Short term basically impossible

网易2015-11-24 08:45:0911月23日挖掘机在天体草皮上已经深度作业。 亚冠决赛第二天,天河体育场的草皮就破土开工了,可见恒大对草皮改造的迫切程度。 决赛中埃尔克森因为草皮太滑错过了一个单刀,那一幕许家印和马云在看台上尽...

- 《画江山》渐入家境1月8日火爆开启

"Painting jiangshan" opened on January 8, gradually into the family hot

新浪2016-01-05 16:48:59新年伊始,去哪里玩耍比较好呢?《画江山》给你推荐好去处,《画江山》贺岁封测将于火爆开启,全新版本全新内容将会带来新年全新感受。不仅游戏会出新系统,时装也将同步上线,让你新年换新衣。并且只要登录就有机会获得IPAD MINI! 《画江山》官

- 张柏芝范冰冰林熙蕾 盘点女星肉搏床戏被摸奶啃胸

Cecilia Cheung Fan Bingbing Kelly Lin was Chuangxi inventory actress melee touch milk on the chest

参考消息网2016-11-02 02:17:18周楚楚:天蝎座 周楚楚《野草莓》情欲剧照全裸无禁忌被压胸 女星周楚楚主演的电影《野草莓》曝光一组剧照,惊现“革命小伙伴”肉搏战的情欲戏。《野草莓》曝情欲剧照,争议“全裸”凸显青春无禁忌。两人光着...

- 曝月球惊人秘密 揭秘宇宙八大未解之谜

Moon Secrets Uncovered exposure amazing eight mysteries of the universe

东北网2016-01-27 22:37:00太阳系由九大行星其中水星、金星、地球、火星及冥王星,是以岩石为主要成份的“地球型行星”,木星、土星、天王星及海王星,是大量气体包围的“木星型行星”。 一、水星如何诞生 太阳系由九大行星其中水...

- 古剑奇谭纪念版降价销售 统一1199元

Gujian commemorative edition sales price 1199 yuan

和讯网2015-08-20 08:26:24《古剑奇谭》的五周年纪念版于8月18日正式开启预售,这部国产经典单机的销售策略也让很多玩家头一次见识到了什么叫做“创意”,采用了每日递增的定价方式,从999元每日递增100元直到8月22日预售活动结束的1399元,对于一款游戏珍藏版来说,这

- 馆陶:深化医改处处惠民 赢得百姓张张笑脸

Guantao formation served: deepen the reform the people everywhere Win the people nervous smile

长城网2016-12-28 23:21:50长城网邯郸12月28日讯(记者 武萌 通讯员 孙长林)馆陶县实施医改3年以来,特别是今年4月份被确定为河北省医改示范县以来,该县按照上级深化医改的总体要求,统筹推进县级公立医院医疗、医保、医药“三医...

- LOL英雄与火影忍者角色对比 大蛇丸竟然是她?

LOL hero Naruto and Orochimaru turned out to be the role of contrast her?

东北网2015-12-19 15:33:11在LOL游戏中,有一个英雄被称为火影!没错,就是劫。其实除了劫之外,其实在很多英雄身上都能看到火影的影子!甚至是神似!下面,一切来看看那些神似火影的LOL英雄吧! EZ&四代 都是高富帅,都是小黄毛!而且EZ的E跟四代的飞雷

- 《冬日逃亡者》评测 挺有创意的越狱

"Winter fugitive" evaluation is very creative jailbreak

43992015-08-20 14:12:11关于越狱,小编第一个想到的就是肖申克的救赎中的主角。经历多少苦难,要具有怎样的毅力才能在那样艰苦的条件下越狱成功。在游戏里,越狱也是一个非常考验玩家智慧的一种游戏内容。《冬日逃亡者》就上演了这么一幕越狱逃亡的好戏,想知道自己能在游戏中逃亡成

- 虚幻4国产18禁游戏原画公布 油腻的师姐等你来看

- 《龙之谷》12分钟序章动画抢先看 新服开放

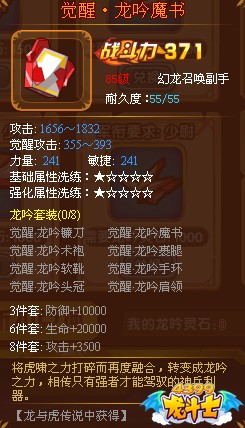

- 龙斗士召唤师觉醒·龙吟魔书

- 虚幻4国产18禁游戏原画公布 油腻的师姐等你来看

- 江山如画《黎明战歌》奇幻领土欣赏

- 大圣西游8月28日追开新服 斩妖除魔匡扶正义

- 纪念品与现实场景的借位摄影

- 天津交通职业学院与橙果空间在津签订众创空间战略项目合作协议

- 《机甲狂潮》将推出一个「西部世界」DLC

- 克劳奇破门肖克罗斯摆乌龙,斯托克城1-1埃弗顿

- 个性设计 Win10手机Neo Nuans开箱上手

- 情人节来了花店酒店忙 女人花钱比男人“豪气”

- 老板燃气灶怎么样 老板抽油烟机哪款好

- 操作方便 中控Smart 3F指纹门禁售300元

- 重庆“李嘉诚”套现脚步停不下 4.5亿售地产公司

- 2017中国城际物流创新发展论坛在上海举办

- 2016年四川省等级医院TOP100品种排行榜

- 为了宣传 iPhone 7 夜拍 苹果这次真的很努力

- 中国品牌阵势逼人 SUV全面布局对标合资

- 三星GALAXY Note 5内部代号曝光 或配4K屏